Rumored Buzz on 501 C

Wiki Article

Not known Facts About Non Profit Organizations List

Table of ContentsAll about Non Profit Organizations ListThe Greatest Guide To Non Profit Organizations ListThe Facts About Non Profit Organizations Near Me RevealedThe Ultimate Guide To Non Profit Organizations Near MeNot known Facts About 501c3 OrganizationNon Profit Organizations List Things To Know Before You BuyGetting My 501 C To WorkSee This Report on Non Profit Organizations Near MeThe Best Strategy To Use For Not For Profit

Included vs - 501 c. Unincorporated Nonprofits When individuals believe of nonprofits, they generally think about incorporated nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, as well as various other formally developed companies. Numerous people take component in unincorporated not-for-profit associations without ever before realizing they've done so. Unincorporated nonprofit associations are the outcome of 2 or even more people working together for the purpose of providing a public benefit or solution.Personal structures might consist of family foundations, private operating foundations, and also corporate structures. As kept in mind above, they normally do not supply any type of services and instead make use of the funds they increase to sustain other philanthropic organizations with solution programs. Exclusive foundations additionally tend to call for even more start-up funds to establish the organization in addition to to cover legal fees and also various other recurring expenses.

More About Non Profit Org

The assets remain in the depend on while the grantor lives and also the grantor may handle the possessions, such as acquiring and also offering stocks or realty. All possessions transferred into or bought by the count on stay in the depend on with income dispersed to the designated recipients. These trust funds can survive the grantor if they include a stipulation for continuous management in the documents made use of to develop them.

Fascination About 501c3 Nonprofit

Alternatively, you can work with a count on attorney to help you develop a charitable count on and also advise you on just how to manage it moving on. Political Organizations While many various other types of not-for-profit organizations have a minimal capability to take part in or advocate for political activity, political organizations operate under different guidelines.

Npo Registration Things To Know Before You Buy

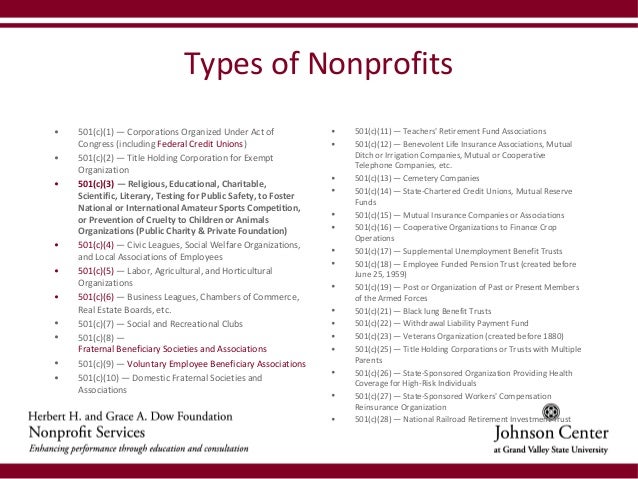

As you examine your options, make certain to seek advice from with a lawyer to determine the most effective method for your organization and also to ensure its correct setup.There are several kinds of not-for-profit organizations. These nonprofits are typically tax-exempt since they work towards the public passion. All properties and revenue from the not-for-profit are reinvested right into the company or contributed. Depending upon the not-for-profit's subscription, mission, and structure, various classifications will use. Nonprofit Organization In the United States, there more than 1.

Facts About Not For Profit Revealed

In the USA, there are around 63,000 501(c)( 6) companies. Some examples of widely known 501(c)( 6) organizations are the American Ranch Bureau, the National Writers Union, as well as the International Organization of Meeting Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) organizations are social or entertainment clubs. The function of these nonprofit companies is to arrange tasks that cause satisfaction, leisure, and socialization.

Excitement About Npo Registration

Typical incomes are subscription dues and also donations. 501(c)( 14) - State Chartered Lending Institution and Mutual Book Fund 501(c)( 14) are state chartered credit report unions and also shared get funds. These organizations offer economic solutions to their participants and also the community, commonly at affordable rates. Income sources are company tasks and government grants.In order to be eligible, at least 75 percent of participants have to exist or previous members of the USA Armed Forces. Financing comes from contributions and government gives. 501(c)( 26) - State Sponsored Organizations Giving Health And Wellness Protection for High-Risk People 501(c)( 26) are nonprofit organizations created at the state degree to Discover More Here supply insurance policy for risky individuals that might not have the ability to get insurance via important source other ways.

About 501 C

Financing comes from contributions or federal government gives. Examples of states with these high-risk insurance swimming pools are North Carolina, Louisiana, and also Indiana. 501(c)( 27) - State Sponsored Employee' Payment Reinsurance Organization 501(c)( 27) not-for-profit organizations are created to give insurance for workers' settlement programs. Organizations that give employees settlements are called for to be a member of these companies and also pay charges.A nonprofit corporation is a company whose objective is something various other than making a revenue. 5 million nonprofit companies registered in the United States.

The Single Strategy To Use For 501c3 Organization

Nobody individual or group has a nonprofit. Possessions from a not-for-profit can be marketed, but it benefits the entire company instead than individuals. While anybody can integrate as a nonprofit, only those who pass the rigid standards set forth by the federal government can accomplish tax excluded, or 501c3, condition.We talk about the steps to coming to be a not-for-profit additional into this web page.

Excitement About Not For Profit

The most important of these is my blog the ability to obtain tax "excluded" standing with the internal revenue service, which allows it to obtain contributions devoid of present tax, allows contributors to deduct donations on their tax return and excuses a few of the company's activities from income tax obligations. Tax exempt standing is essential to lots of nonprofits as it urges contributions that can be utilized to sustain the goal of the organization.Report this wiki page